Thursday, March 18, 2010

Jones Murphy former astrophysicist and Wall Street insider talks to theDominican.net radio

The Dominican.net Newsdesk

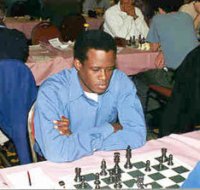

Jones Murphy the ‘Dominican Whiz Kid’ who is a former Director at Williams Companies, and a Wall Street Trader who handled some of the biggest accounts for AIG Financial Group, Citi Bank and Bank of America spoke to the Dominican.net and Thomson Fontaine in an exclusive interview on Wednesday March 24 at 8:00 P.M.

The interview which can be heard at thedominican.net radio will focus on the economic situation in the US and the culture of trading and excessive risk taking on Wall Street, which is at the center of the current economic crisis. Jones knows the culture well having been a major Wall Street insider and one of the most powerful black Wall Street executives, who handled hundreds of millions of dollars in trades.

AIG Financial Group, Citi Bank and Bank of America, the companies where Jones worked as a trader, all received large bail outs from the US government.

At Bank of America where he was an Assistant Vice President for the hybrid derivatives group, he managed accounts for some of the biggest names on Wall Street like Goldman Sachs. During his time on Wall Street, Murphy was one of only a handful of black executives occupying such a position.

In August 2000 Williams Companies, the second-largest owner of natural gas pipelines in the United States hired Murphy as director of emerging products at its Tulsa Oklahoma headquarters, to help manage its trading risks.

At the time, Murphy was promised wide latitude to develop financial instruments to manage the credit, currency and interest rate risk that the company encountered in trading.

If not properly managed, those risks could lead to hundreds of millions of dollars in losses. The company has over 12, 000 employees and in 2001 recorded sales of over $11 billion.

In 2002 he was headlined in the New York Times (see story) after blowing the whistle on the company for allegedly conspiring to drive up natural gas prices.

In 2000, a full year before the demise of Enron, Jones repeatedly warned the Williams Company about Enron’s impending demise and their eroding creditworthiness.

In one e-mail message, Mr. Murphy recounted ''an awful meeting Oct 28th, where I basically fought a lonely battle to hedge, slow pay and otherwise protect the company against Enron's deteriorating situation.''

In another e-mail message to Stephanie Cipolla, the head of human resources at the energy marketing and trading unit, Mr. Murphy wrote: ''We're getting up to over a year now, and this money has cost us something like 50 million interest costs on funding the 800 million hole in our balance sheet. I would have hedged that risk for much less than a 50 million bonus, honest.''

Jones is a former astrophysicist, who abandoned his research of Black Holes for a career in corporate America. He attended the St. Mary's Academy and the Sixth Form College in Roseau, Dominica before simultaneously receiving the Dominica Island Scholarship, the University of the West Indies Scholarship Award and several scholarship offers from universities across the United States.

In 1981 he moved to the United States to pursue studies in physics, mathematics and chemistry at Cal Tech and M.I.T. He later settled on astrophysics before moving on to the high stakes world of trading on Wall Street.

Jones is currently with Quanta Funds an investment company he founded that deals largely in diversified portfolios including derivative securities. He is headquartered in Italy.

Jones Murphy the ‘Dominican Whiz Kid’ who is a former Director at Williams Companies, and a Wall Street Trader who handled some of the biggest accounts for AIG Financial Group, Citi Bank and Bank of America spoke to the Dominican.net and Thomson Fontaine in an exclusive interview on Wednesday March 24 at 8:00 P.M.

Jones Murphy former Wall Street Executive talks to theDominican.net radio. |

The interview which can be heard at thedominican.net radio will focus on the economic situation in the US and the culture of trading and excessive risk taking on Wall Street, which is at the center of the current economic crisis. Jones knows the culture well having been a major Wall Street insider and one of the most powerful black Wall Street executives, who handled hundreds of millions of dollars in trades.

AIG Financial Group, Citi Bank and Bank of America, the companies where Jones worked as a trader, all received large bail outs from the US government.

At Bank of America where he was an Assistant Vice President for the hybrid derivatives group, he managed accounts for some of the biggest names on Wall Street like Goldman Sachs. During his time on Wall Street, Murphy was one of only a handful of black executives occupying such a position.

In August 2000 Williams Companies, the second-largest owner of natural gas pipelines in the United States hired Murphy as director of emerging products at its Tulsa Oklahoma headquarters, to help manage its trading risks.

At the time, Murphy was promised wide latitude to develop financial instruments to manage the credit, currency and interest rate risk that the company encountered in trading.

If not properly managed, those risks could lead to hundreds of millions of dollars in losses. The company has over 12, 000 employees and in 2001 recorded sales of over $11 billion.

In 2002 he was headlined in the New York Times (see story) after blowing the whistle on the company for allegedly conspiring to drive up natural gas prices.

In 2000, a full year before the demise of Enron, Jones repeatedly warned the Williams Company about Enron’s impending demise and their eroding creditworthiness.

In one e-mail message, Mr. Murphy recounted ''an awful meeting Oct 28th, where I basically fought a lonely battle to hedge, slow pay and otherwise protect the company against Enron's deteriorating situation.''

In another e-mail message to Stephanie Cipolla, the head of human resources at the energy marketing and trading unit, Mr. Murphy wrote: ''We're getting up to over a year now, and this money has cost us something like 50 million interest costs on funding the 800 million hole in our balance sheet. I would have hedged that risk for much less than a 50 million bonus, honest.''

Jones is a former astrophysicist, who abandoned his research of Black Holes for a career in corporate America. He attended the St. Mary's Academy and the Sixth Form College in Roseau, Dominica before simultaneously receiving the Dominica Island Scholarship, the University of the West Indies Scholarship Award and several scholarship offers from universities across the United States.

In 1981 he moved to the United States to pursue studies in physics, mathematics and chemistry at Cal Tech and M.I.T. He later settled on astrophysics before moving on to the high stakes world of trading on Wall Street.

Jones is currently with Quanta Funds an investment company he founded that deals largely in diversified portfolios including derivative securities. He is headquartered in Italy.

| | Home Page | Dominica |Welcome Message | Prior Issues|Flag and Symbols | Dominica Constitution | Bulletin Board |Contact Us |Local Headlines |Discussion Board |Radio & TV |Cricket | Current Issue |

Comments:

Links to this post:

<< Home

I LISTENED 2 UR INTERVIEW EARLIER IT WUZ SOLID M PROUD OF MURPHY N HIS ACCOMPLISHMENTZ N M ESPECIALLY HEARTENED BY HIZ WILLINGNESS 2 CONTRIBUTE BACK HOME KEEP UP THE GUUD WORK IF U NEED A CORRESPONDENT IN SOUTH FLORIDA HOLLA THIS IZ GARY JOSEPH FROM THE DAAS FOOTBALL TOURNAMENT ONE LOVE

Gary, great hearing from you...cool memories. Send me your contact will certainly use the help.

thomson

thomson

Hey Thompson,

The Career synopsis of the Whiz kid, is great, and is well within my expectations. I'm proud of the hieghts that you guys have attained.

I always wanted to know how Jones was doing because he disappeared soon after graduation from SMA. Jones, Thompson Zead - big up.

The Career synopsis of the Whiz kid, is great, and is well within my expectations. I'm proud of the hieghts that you guys have attained.

I always wanted to know how Jones was doing because he disappeared soon after graduation from SMA. Jones, Thompson Zead - big up.

Links to this post:

<< Home

Subscribe to Posts [Atom]

Post a Comment

Please Provide Opinions and Comments on This Article.